Winning at Website Accessibility in 2026—Alternatives, Tax Credits, and More

This article is aimed at a USA audience but much of the general principles apply in other countries. This is not legal or financial advice.

What is Website Accessibility (A11Y)?

Accessibility, in general, is making sure your product or service is accessible to people with physical or mental difficulties, such as color blindness, sensitivity to flashing lights, and being hard of hearing. Imagine that you are deaf but want to watch a YouTube video… that’s why YouTube auto-generates captions.

“Accessibility” is a long word, not easily typed out, so it’s abbreviated as “A11Y” because there are 11 letters between the “A” and “Y”.

Six types of disability measured

Using data from the 2016 Behavioral Risk Factor Surveillance System (BRFSS), this is the first CDC report of the percentage of adults across six disability types:

- Mobility (serious difficulty walking or climbing stairs)

- Cognition (serious difficulty concentrating, remembering, or making decisions)

- Hearing (serious difficulty hearing)

- Vision (serious difficulty seeing)

- Independent living (difficulty doing errands alone)

- Self-care (difficulty dressing or bathing)

We’re about to get into some unpleasant answers—some hard truths—so I want you to view A11Y as “glass half full,” not as a nuisance… don’t worry, there’s good news at the end of this article.

Take the YouTube captions example… statistically, you (yes you) are reading this without a disability that affects your ability to read this… but you’ve watched videos without audio before and appreciated the auto-generated captions or the “burned in” captions (the kind where the video includes the words on-screen).

Just like a wheelchair ramp at your office that helps the non-disabled delivery driver wheel up extra large packages, you should view A11Y solutions as improvements to your website that everyone benefits from. Consider it part of elevating your user experience (UX). Plus, it opens up your site to be usable by a greater number of people, since it can effectively serve those with and without disabilities.

How Important is Website Accessibility?

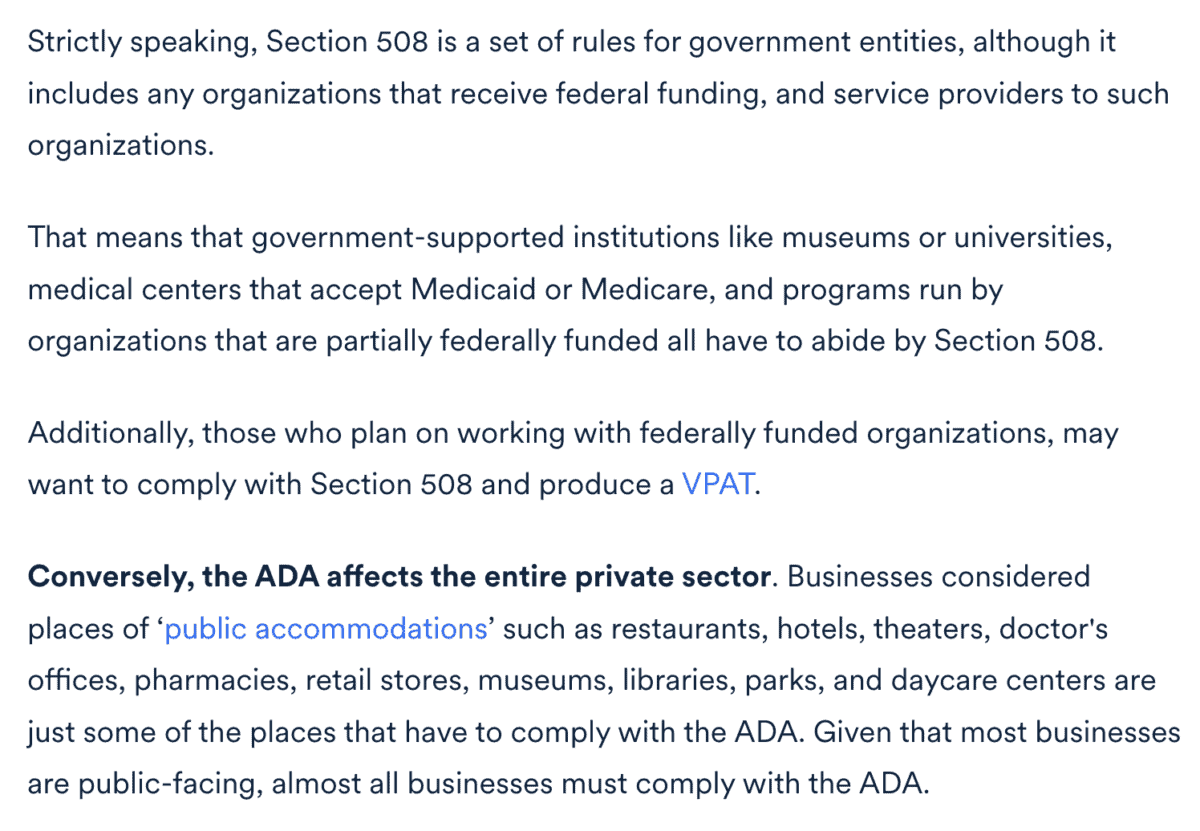

It its 2018 amendment, the Americans with Disabilities Act (ADA) decided that websites are subject to their disability compliance laws since they’re considered public places of accommodation. Additionally, this ADA revision expanded what qualifies as a disability, opening up the possibility for many more potential lawsuits.

In the previous section, we talked about how solving A11Y problems actually improves the UX for everyone, even those without disabilities.

Here, we see that A11Y is so important, the government requires it of themselves and of almost all websites.

Solving Website Accessibility Automatically…

…is NOT possible…

If you see any website subscription that mentions “AI powered” or “one-click compliance” then it’s an overlay. The most popular pervasive overlay implementations come from UserWay, accessiBe, and AudioEye.

They all claim to install a drop-in JavaScript widget (copy and paste solution) that automatically fixes all of your website’s accessibility issues via AI, dramatically reducing the cost of manual remediation. Since it’s not a manual service, the cost is significantly lower and the benefits claim to be ongoing.

Unfortunately, the worse-than-doing-nothing overlay solution is commonly recommended by less-informed freelancers and marketing agencies. Accessibility is one of the many specializations within the world of website design and development, just like user experience (UX) is a different specialty from search engine optimization (SEO).

Manually Fixing A11Y Issues

Even if an overlay for $50 per month could improve some parts of your website accessibility (but they don’t—seriously, don’t use them at all), it still couldn’t improve all of your website’s A11Y issues. The overlay companies admit they cannot solve these types of issues:

- videos

- PDF files and Word documents

- fixing incorrect alternative text (won’t override existing alt text)

- forms

Your overlay not only makes your site less accessible but also won’t be able to fix the most common non-text items like videos, documents, and webforms?

Like most manual services, they’re not inexpensive and they require ongoing maintenance. If your website ever changes—WordPress plugin updates, new blog posts, color scheme changes, etc.—then you probably don’t need ongoing maintenance. If you’re investing into your website with new content, SEO, conversion rate optimization (CRO), or any number of reasons your site is not static long-term, then making A11Y fixes manually once is better than none, and monthly/quarterly/annually is even better.

If you shop around, you’ll find all sorts of pricing, but it’s common for A11Y services to cost $800–$1,200 per page. And there are different levels of targeted compliance and usually don’t come with guarantees. The overlay companies market strong legal defense features, but their follow-through is weak at best. Overlay companies have even been sued by the US Government for not doing what they claim to do.

You Get SEO Benefits For Free

Okay, finally some good news!

A lot of technical SEO optimization lines up with A11Y compliance. For example, adding alt tags to images helps both vision-impaired humans and “blind” search engines (meaning Google does not “see” your image like with human eyes) better understand what your images visually represent.

Your blog post outline with hierarchical headings—h3 within h2, h2 within h1—helps both screen reader technologies and search engines quickly understand your article’s outline.

A lot of the accessibility best practices go hand-in-hand with SEO best practices!

Why You Should NOT Subscribe to an A11Y Overlay Subscription

Unfortunately, this is the bad news section for multiple reasons…

A common solution is to pay about $50 per month for a drop-in solution, basically where the customer wants to pay for the “problem” to go away.

Unfortunately, it’s more than a 100% waste of money because:

- it does not not make your website more accessible, in fact making it less accessible

- it’s careless, not caring to learn more

- it puts a target on your back, exposing you as aware of the problem but ignorant of the solution, inviting savvy legal teams to target you with frivolous lawsuits

https://highlevel.stoplight.io/ idk how much you know about web accessibility but…

TLDR; Accessibility overlays are literally the worst thing you can do for web accessibility.

Overlay widgets are unnecessary and are poorly placed in the technology stack.

While some automated repair is possible, customers should be discouraged from using an overlay as a long-term solution.

They reinforce discrimination. Site owners, lulled into a false sense of security, then do nothing else to improve access, which is harmful to individuals with disabilities.

You can still be sued! Many overlay companies count on your lack of knowledge about accessibility and sell empty promises that will not shield you from litigation. In 2025, the FTC even fined accessiBe 1 million dollars for falsely claiming it could make websites fully accessible. Don’t play the fool!

Accessibility Overlays Make You An Easy Target for Lawsuits 25% of all accessibility lawsuits cited overlays specifically as the problem, not the solution to the legal compliance of the website. Trolls know they don’t work.

Accessibility Resources

AudioEye offers a thorough website accessibility Checklist that’s a great resource regardless of which accessibility solution you choose.

Business News Daily has a thorough list of website accessibility FAQs, including explaining what it is, which businesses are required to comply with federal regulations, and documenting some benefits of offering an accessible website to the public even if you’re not required to:

$5,000 Tax Credit? Yes, please!

The Disabled Access Tax Credit (Form 8826) is a non-refundable credit for small businesses that have expenses for providing access to persons with disabilities. Eligible expenses include installing a wheelchair ramp or making your website conform with accessibility guidelines.

An eligible small business is one that earned $1 million or less or had no more than 30 full-time employees in the previous year. The business does not need to meet both eligibility requirements.

Here’s how it works: qualifying businesses may receive a tax credit for up to 50% of expenditures up to $10,000 after the first $250, for a maximum credit of $5,000. A business may claim the credit for each year they incur expenditures related to accessibility.

For example, if you paid $3,000 in eligible expenses, minus $250, then divide by 2 = $1,375 in tax credits from $3k spend (45.83% in this example). Keep in mind, this is for all disability-related expenses, not only website accessibility expenses.

Organizations exempt from complying with the ADA are those with fewer than 15 employees, but these organizations would definitely qualify for the tax credit regardless of their revenue, since they have 30 or fewer FT employees.